SK Hynix to Cut CapEx, Accelerate Transitions, 1z nm DRAM & 128L 4D NAND in 2020

by Anton Shilov on February 3, 2020 8:00 AM EST

Following a massive revenue and profitability drop in 2019, SK Hynix has announced that it plans to cut down its capital expenditures. While the market has shown some signs of recovery, the company is uncertain about demand for DRAM and NAND, so its investments will get considerably more conservative and prudent. As a result, SK Hynix will focus on acceleration of technology transitions to cut costs and prepare for next-generation products.

A 33% Year-over-Year Revenue Drop

SK Hynix’s revenue for fiscal year 2019 came in at KRW 26.99 trillion ($22.567 billion), a 33% drop from 2018, whereas its net income totaled KRW 2.016 trillion ($1.685 billion), a whopping decrease of 87% from 2018. For the fourth quarter 2019, the company posted a revenue of KRW 6.927 trillion ($5.792 billion), a 30% YoY decline, as well as an operating profit of KRW 236 billion ($197.3 million), a 95% decline compared to the same period a year before.

SK Hynix attributes miniscule profitability in the final quarter of the year to a 7% decline of DRAM ASP quarter over quarter amid an 8% increase in bit shipments as well as to flat NAND pricing amid 10% higher bit shipments. Meanwhile, SK Hynix’s net loss for the quarter totaled KRW 118 billion ($98.662 million) as it had to re-evaluate its investments in Kioxia.

CapEx Cuts Coming

SK Hynix’s losses are a result of dropping DRAM and 3D NAND prices because of oversupply and overall uncertainties on the market. To that end, it has determined that it needs to concentrate on cutting costs and expenditures, which is a reason why the manufacturer is reconsidering its capital expenditure plan. Last year SK Hynix’s CapEx was cut by 25% (vs. 2018) to KRW 12.7 trillion ($10.619 billion) because of the price drops. Apparently, this year the company will cut it down even further, but at this point it does not have a number it wants to share.

Jin-seok Cha, CFO of SK Hynix, said the following:

“As was the guidance last year, CapEx this year will be considerably reduced year-on-year. Infrastructure CapEx will be focused in M16 scheduled to be completed this year, and equipment CapEx will be concentrated mostly in tech migration to 1y nanometer [DRAM] and 96 and 128 layer [3D NAND]. Meanwhile, as we continue with the conversion of DRAM capacity in M10 into CMOS image sensor and 2D NAND capacity into 3D this year, wafer capacity at year-end is planned to be lower than at the beginning of the year for both DRAM and NAND.”

Accelerate Transitions & Focus on High-Value Products

Demand for 3D NAND and DRAM in terms of bits will without any surprises continue to increase this year, so no producer is likely to cut bit output. As such, SK Hynix intends to accelerate its transition to newer process technologies in a bid to cut its per bit costs. Moreover, the company plans to ensure that its next-generation products do not have ‘glitches’.

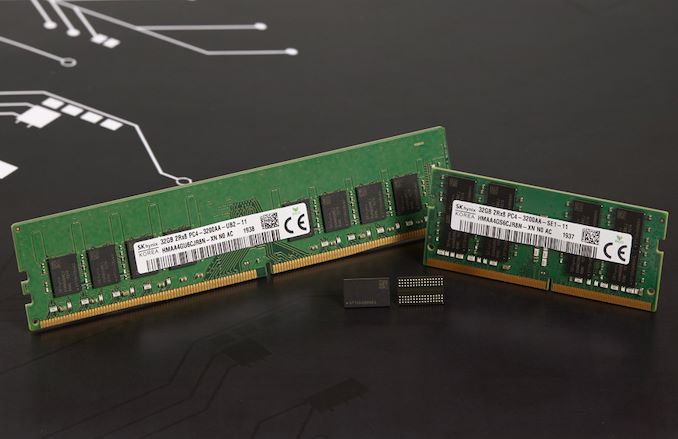

SK Hynix says that the share of DRAM it makes using its 2nd Generation 10 nm-class fabrication process (1Y nm) will increase to 40% by the end of the year. On the NAND side of things, over half of NAND bits the company produces will be made using its 96-layer 3D NAND technology already in the first half of 2020.

Mr. Jin-seok Cha said the following:

“The company will accelerate cost reduction by steadily improving technology maturity in the process of tech migration and prepare next-generation products without glitches. The big portion of 1y nanometer products within DRAM will be increased to 40% level by year-end, whereas for 96-layer 3D NAND, it will cross over in the first half.“

More advanced process technologies promise to reduce SK Hynix’s costs, but in a bid to improve revenues and profitability, the company plans to better address high-value markets and products. In particular, the company will ‘actively respond’ to demand for LPDDR5, GDDR6, and HBM2E on the DRAM side of business, as well as increase sales of SSDs in general and datacenter drives in particular on the NAND side of things.

Here is what the CFO said:

“We will also actively respond to the LPDDR5, GDDR6 and HBM2E markets that are expected to go into a full-fledged growth this year by bolstering quality competitiveness and broadening our product portfolio into strategic markets. And we will accelerate sales of SSD products for data centers and keep increasing the portion of SSD sales, which topped 30% for the first time in the fourth quarter of last year.”

1z DRAM & 128-Layer 4D NAND Due in 2020

Last year SK Hynix finished development of its 3rd Generation 10 nm-class process technology for DRAM (1Z nm) and also commenced sample shipments of its 128-layer ‘4D’ NAND (which is still called ‘3D NAND’ by officials) featuring the company’s charge trap flash (CTF) design, along with the peripheral under cells (PUC) architecture.

This year, both technologies will be used in mass production, but their share is not going to be significant.

“We will start mass production of 1z nanometer [DRAM] and 128-layer 3D NAND, the next-generation products, within this year.”

Cautiously Optimistic

Like other industry players, SK Hynix sees huge potential in application of emerging technologies, such as 5G and AI, which is why it is optimistic about the future in general. Meanwhile, despite some signs of recovery, not everything is back to normal, according the the company's management, and so the company is conservative both about predictions and about spending.

Related Reading:

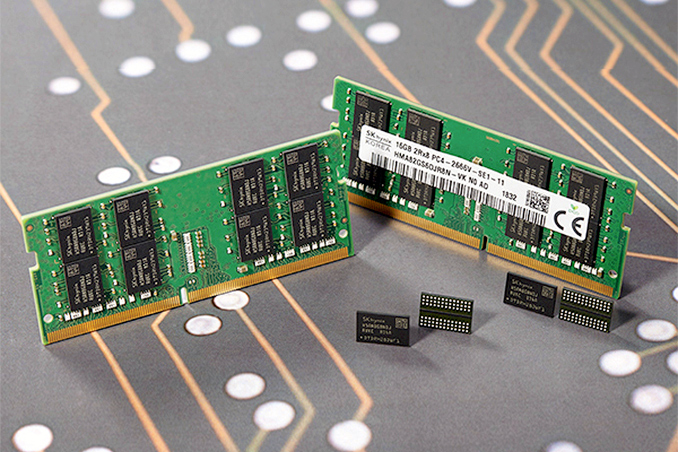

- SK Hynix Develops 16 Gb DDR4 Chips for 32 GB Modules

- SK Hynix Sampling 128-layer 3D NAND SSDs

- SK Hynix Starts Production of 128-Layer 4D NAND, 176-Layer Being Developed

- SK Hynix Announces 3.6 Gbps HBM2E Memory For 2020: 1.8 TB/sec For Next-Gen Accelerators

- SK Hynix NAND Update: 3D NAND Output Cut, Slowdown Capacity Expansions

Sources: SK Hynix, Yahoo Finance, Reuters

6 Comments

View All Comments

Soulkeeper - Monday, February 3, 2020 - link

They complain about lower prices. Yet the consumers aren't seeing it.I guess the middle man is getting fat.

Or have I missed something ?

The same ram was cheaper like 2yrs ago.

FreckledTrout - Monday, February 3, 2020 - link

Probably Samsung B-die made Hynix the budget player and Samsung B-die became pretty cheap over the last year. I know I put 32GB of 3200Mhz CAS 14 ram(14-14-14-34) im my old Ryzen build for $240.kn00tcn - Monday, February 3, 2020 - link

all dies are cheap over the last year, but bdie still costs more than a small amount over hynix or micron (even the other lower tier samsung dies), 32gb non-b would readily be below $200 or even $175 usdkn00tcn - Monday, February 3, 2020 - link

um '2yrs ago' was the worst time for ram along with gpus in recent history, with prices of AT LEAST twice as expensive as now, not to mention stock shortages due to miningthe cheapest ddr4 was end of summer 2016 or end of fall 2019

there are sites for price history per kit, fuzzy anecdotes are obsolete

Adramtech - Monday, February 3, 2020 - link

Soulkeeper, they're losing money. If you do that long enough you go broke. DRAM has dropped a ton the past two years.frenchy_2001 - Thursday, February 6, 2020 - link

" an operating profit of KRW 236 billion ($197.3 million), a 95% decline compared to the same period a year before."They are still making money, just much less than last year.